What

if there was a way for 'We, The People' globally to acquire pure

physical gold easily, cheaply and securely utilizing the power of the

web. Well, GoldMoneys’

stated mission is to democratize global access to real physical gold

for stable savings, and to make gold useful in transactions (from micro

up) using the Internet or mobile phones, and at point of sales with a

free MasterCard debit card.

Folks, it’s free to join,

easy to fund in any amount, secure, offers the lowest price to

buy/highest price to sell, actual allocated 99.95% plus pure physical

deliverable gold, with 24/7 liquidity, a free MasterCard debit card for

purchases, and all this with the lowest fees in the industry!

If that's not truly

then I don't know what is.

“We are excited to unveil the GoldMoney platform, an architecture and technology that’s taken years of careful planning and execution, which now allows users to seamlessly use gold again as a store of value and medium for payments,” said co-founder and CEO Roy Sebag.

“As a global asset, gold is recognized in nearly every culture as a long-term protector of value, but has been a poor medium of exchange compared to the advances in money technology,” Sebag said. “We felt that gold needed the modernization and mobilization that’s now happening in the global payments revolution. We have built a financial services platform that is as close to being counterparty-free as possible, enabling economic transactions within the existing global financial system to be settled in full reserved gold bullion.”

Hello Everyone,

I'm sure you're wondering what in the world is 'The GoldMoney Revolution’, and how is it ‘free for all’, right?

This looks to me to be important, (nothing is for sure about the future, of course) so giving good attention should be very worth your while.

I feel strongly, as I hope you do also, that the current global financial system is monstrous, in that an impure, debt based ‘fiat’ system like the one we have necessarily encourages widespread over-indebtedness (essentially debt slavery) of the 'common' people, to the great financial advantage of the power elite.

The key issue in this situation that is not well understood happens to involve GOLD at its centre, which is what we will be addressing here.

Background

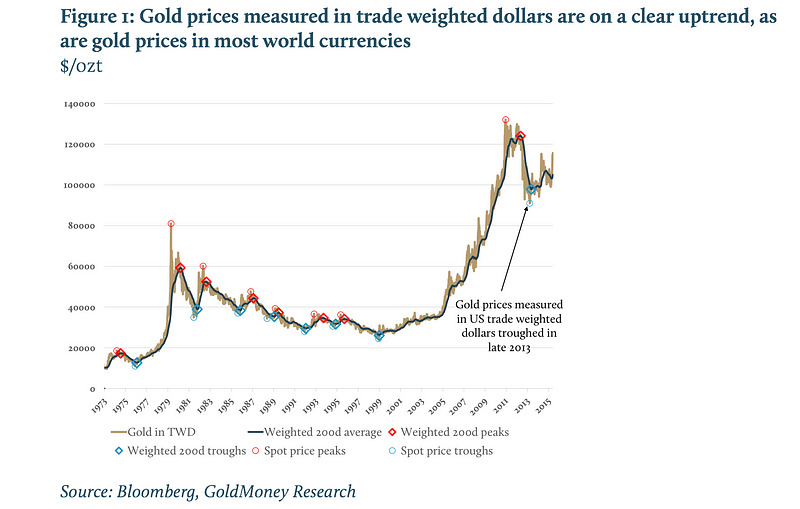

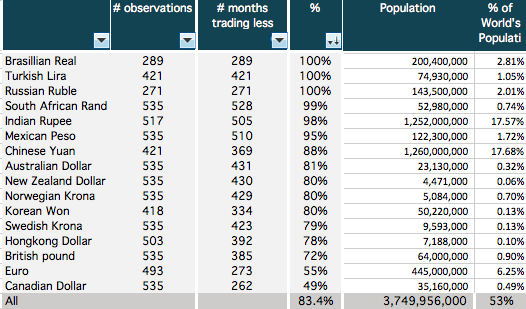

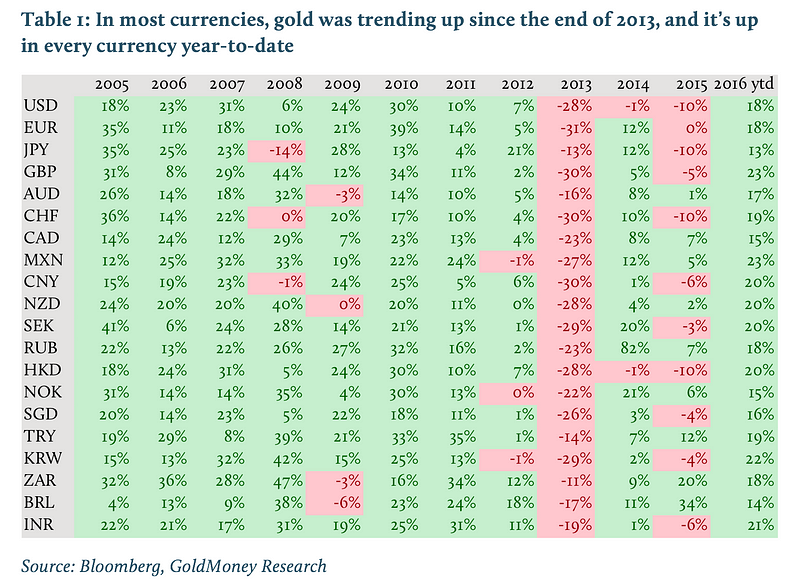

For a system like our current one to function it needs the ‘debt based fiat' currency to be accepted, not just as a means of exchange, (which is the only true role of a currency), but also as the markets 'store of value' (SOV), which historically has been the role of gold. (a means of saving ‘value’ for longer term future use) To accomplish this the ‘elite’, through the misuse of gold paper derivatives (futures, gold certificates, hedges, etc), both suppresses and makes volatile the gold price. This destroys the critical trust that Gold will be able to hold its value over time, which a SOV needs to do. That effectively blocks gold from acting as the store of value, which opens that role up to ‘fiat’. (which is of course the whole point of the exercise)

Those same elite know this whole situation is a con job which greatly distorts natural market structures, and is therefore destined to eventually fail, so while they themselves hold plenty of gold secured quietly away in vaults and have their private banks (so called central banks) hold lots of gold as reserve assets, they at the same time discourage physical gold ownership for the common people, both with propaganda (it doesn't pay a dividend, is useless, etc) and physically by making sure it is not widely easy to acquire and outlawing its use as a means of exchange, while at the same time encouraging paper gold which they easily control (which also sets the physical gold price).

So what does this have to do with this GoldMoney, thing, you ask? Lets find out;

There have been a number of attempts to provide a net-based physical gold purchase, storage, and digital trading platform for the modern era, but none of them were really successful. They all had some major weakness; like they were kind of 'fly by night', or had clunky relatively expensive wire transfer account funding good only for large players, or didn’t provide for taking delivery, or that the gold delivery was only available in large quantities. And none of them provided a means to make point of sale consumer purchases.

Well, folks, I’m happy to be able to say, (drum roll) - its finally arrived - I’m very pleased for you to meet:

“We are excited to unveil the GoldMoney

platform, an architecture and technology that’s taken years of careful planning and execution, which now allows users to seamlessly use gold again as a store of value and medium for payments.”

Co-founder and CEO Roy Sebag

- Well financed? - check

- Strongly backed? - check

- Publicly traded transparent company? - check

- Officially registered Canadian precious metals dealer? - check

- Pure allocated physical gold? - check

- Secure? - check

- No counter party/bail-in risk? - check

- Free and easy online account setup? - check

- Lowest fees? - check

- Free gold storage? - check

- Multiple act. funding options (bank/Interact/credit/debit cards etc)? - check

- Multiple free international insured gold storage locations? - check

- Buy/sell/send any amount of gold with 24/7 liquidity? - check

- Deliverable pure physical gold in small or large amounts? - check

- Free debit card for global point of sale transactions? - check

- No currency conversion fees? - check

- Frequent physical gold audit by major accounting firm? - check

- Make and receive instant payments of any size? - check

- Free Affiliate program available? - check

- GoldMoney is a very secure, officially certified, Canadian government regulated, digitally based, precious metals dealer and financial platform where your money is denominated in physical gold. It’s like any other bank account in that you can deposit money that is converted at the current rate for gold, and you can spend it in any currency or transfer/take delivery of it as gold.

- GoldMoney is not some fly by night operation. It is a strongly funded and backed (Soros, Sprott, Sandstorm, Dundee, Clarus etc) publicly traded company.

- GoldMoney is not a pseudo, cloud, or crypto currency. It is real, allocated physical 99.95% + pure gold securely stored, individually allocated and reserved in your name, in insured Brink’s vault depositories located at your choice in Zurich, Hong Kong, London, Singapore, Toronto or Dubai. It is 100% insured.

- The gold belongs to you. GoldMoney does not re-hypothecate, hedge or otherwise pledge your gold for any reason at any time. It’s your gold, period.

- You can think of GoldMoney as like PayPal but denominated in grams of gold. You can transfer or receive gold with any other BitGold user. You can spend it in local currency anywhere with a free MasterCard debit card.

- Due to American financial regulations, GoldMoney cannot be used for transactions by US residents. (but they can buy/sell/take delivery)

- GoldMoney is issuing free MasterCard debit cards for account holders.

- GoldMoney offers the most competitive rates in the industry for buying and selling gold (new 0.5%), and is the only platform that allows users to purchase point of sale merchandise from their gold account (free debit card) wherever credit/debit cards are accepted. (not available in USA due to anti gold regulations)

- GoldMoney maintains a stock of gold in their own account. When an account holder wants to buy or sell gold, they buy from or sell it to GoldMoney at the current official spot price of gold. GoldMoney charges a very low 0.5% fee for either buying or selling gold or receiving payments. That’s how they make their money. GoldMoney doesn’t charge anything for sending/receiving from one account holder to another or for storage. For the account holder GoldMoney offers the lowest price available anywhere to buy gold, and the highest price to sell gold with 24/7 liquidity.

- GoldMoney account holders may deposit money into their account via Bank Wire transfers, bank account, credit or debit cards, China UnionPay, Interac or SEPA. Accounts offer the highest military grade security. The gold is purchased with U.S. dollars (because that’s how physical gold is traded globally) but note that GoldMoney charges no currency conversion fees.

- The company’s financial statements and stored gold are regularly audited by major international accounting firm Price Waterhouse Coopers.

- GoldMoney account holders may sell gold and transfer money back out of their account at any time based on the current price of gold. Should account holders want physical gold, they can take delivery in either 10-gram cubes or 1-kilo bars. There is a small, about $25 CAD, redemption for either the 10-gram cubes or 1-kilo bars (plus shipping fee for cubes only).

- GoldMoney has no counter party/bail-in risk. You own the gold. It’s yours. Every gram of gold in your account is your property: fully reserved, allocated, and redeemable under Bailment Law in Canada as per the Customer Agreement.

- There are no gold bullion storage or insurance fees. (zip/zilch/nada)

- The only fees for physical delivery are the $25 CAD redemption fee (plus shipping for gold cubes).

- GoldMoney is not a securities dealer or financial institution. It is a registered precious metals dealer and provides many valuable advantages/services available nowhere else, at very low cost. When the banking system crashes, your gold is safe. No bail-in is possible and there is No counter-party risk.

- The safest way to own gold is to hold it in your hands. GoldMoney is the second safest way to own gold.

- Governments around the world have declared a war on cash. With GoldMoney you have the benefit of having access to your money in the form of gold. You effectively have cash without having cash. Very cool.

I feel certain that GoldMoneys’ unique and valuable service is going to be very successful.

Why would anyone who learns about GoldMoney not sign up? After all, it’s free to join, easy to fund in any amount, completely secure, offers lowest prices to buy/highest price to sell/transfer actual allocated 99.95% + pure physical deliverable gold, 24/7 liquidity, and all this with the lowest fees in the industry!

Meet the ‘new Paypal’, folks.

What if there was a way for 'We, The People' globally to acquire pure physical gold easily, cheaply and securely utilizing the power of the web. Well, GoldMoneys’ stated mission is to democratize global access to real physical gold for stable savings, and to make gold useful in transactions (from micro up) using the Internet or mobile phones, and at point of sales with a free MasterCard debit card.

Folks, it’s free to join, easy to fund in any amount, secure, offers the lowest price to buy/highest price to sell, actual allocated 99.95% plus pure physical deliverable gold, with 24/7 liquidity, a free MasterCard debit card for purchases, and all this with the lowest fees in the industry!

If that's not truly

then I don't know what is.

platform, an architecture and technology that’s taken years of careful planning and execution, which now allows users to seamlessly use gold again as a store of value and medium for payments.”

- GoldMoney is not a pseudo, cloud, or crypto currency. It is real, allocated physical 99.95% + pure gold securely stored, individually allocated and reserved in your name, in insured Brink’s vault depositories located at your choice in Zurich, Hong Kong, London, Singapore, Toronto or Dubai. It is 100% insured.